The Economic Slowdown Needs Immediate Address

|

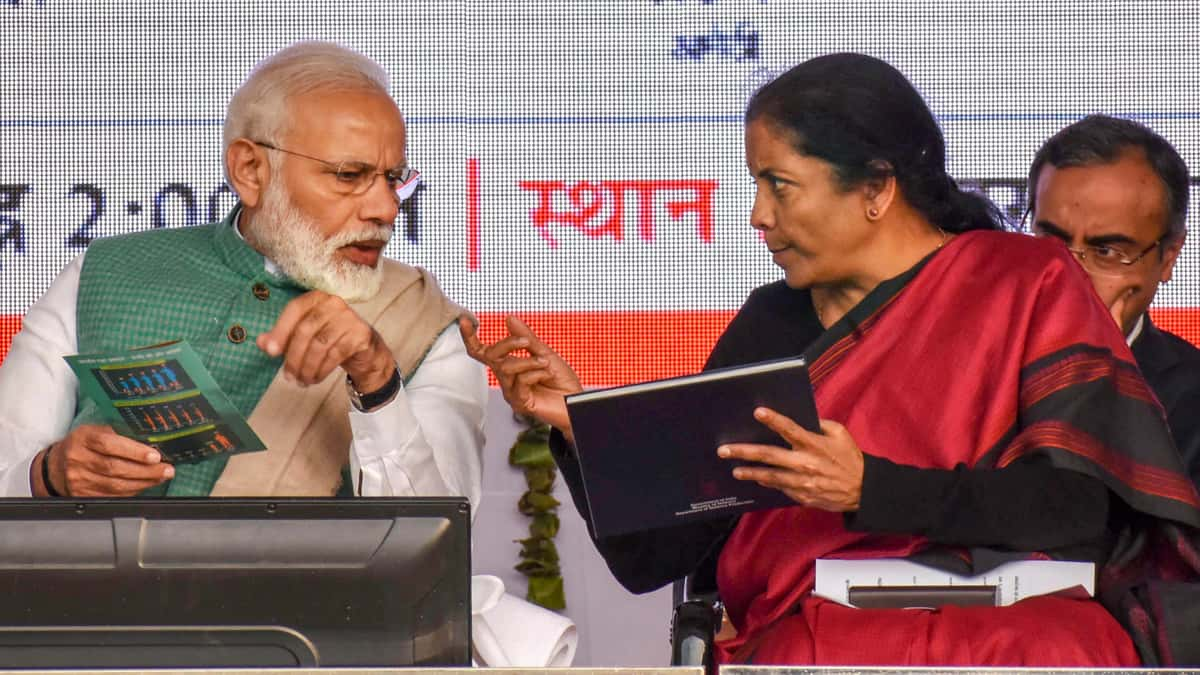

| The Buck Stops With the Duo (Courtesy: Bloombergquint) |

The fracas in Maharashtra notwithstanding, things are at a

critical juncture with respect to the economic scenario. Not undertaking critical

labour and land reforms in the previous terms of course have contributed;

however, the lack of steps is not really the problem right now. The real

problem at this stage is a dampened sentiment about the state of the Indian

economy. This sentiment has essentially been harmed by a handful of reasons

that are not being addressed suitably:

- GST – yes, it is proving to be a dampener. While I had back then too stated that its benefits were being overstated, the GST mechanism per se needs fixation. While tax collection is immediate and even before payments are received by the suppliers of goods and services, the input credit necessary to keep many businesses afloat and flush with working capital is taking unduly long. Steps have been announced to attempt tax reform; however, this step is yet to be addressed by the GST council. The government really needs to face the truth on this.

- Tax terrorism and tax litigation – tax inspectors are proving to be the proverbial Pandora’s box. The genie has been let out of the box and the government has frankly not gotten a grip on this bureaucratic setup. Steps have finally been announced; however, much damage has been done. Similarly, the tax litigation of pre-GST era is still ongoing, with more than 60 lakh crores stuck at various levels of tribunals and courts. On top of that cases like Vodafone only serve to make the central government look like a banana republic.

- Poor industry-financial sector relations – there is minimal trust between the two. Largely driven by the Reserve Bank of India’s crazy rules on identification of non-performing assets (NPAs), banks are hell bent of declaring any and every loan, even if serviceable, as an NPA. Some level of backing down by the RBI is certainly necessary. In the same vein, the country’s institutions also need to be less obsessed with fiscal deficits and inflation targeting, and with a strong rupee.

- Bureaucratic intransigence – Fear of being deemed corrupt thanks to a bunch of over-eager watchdog institutions and voices of the public, as could be seen in the case of Rafale purchases. This has meant that those who want to move the agenda are tied down, delaying critical decision making. Political shenanigans are creating further pressure, hurting India’s image when it least needs it.

Steps are ongoing in this direction to resolve, and the Finance Minister has also been candid in accepting that all is not well. However, it needs to be understood that big ticket spending in certain areas can become a catalyst right away. Only so much of highway building can help. Disinvestments will certainly help, but only in terms of raising liquidity. Addressing the issues mentioned above on war footing is certainly going to help. This is where a few big-ticket projects can really help to turn the tide around. Some projects have been under discussion, though I feel a few stand out in really pushing the agenda on economic growth in multiple ways:

- Jewar airport near NOIDA in Uttar Pradesh, whose tender has just been awarded.

- Building a high-speed rail in an alternate corridor, given the new Maharashtra government’s opposition – possible Hyderabad-Bengaluru.

- RRTS corridors between Delhi-Chandigarh, feasibility study already being undertaken.

- City gas distribution system layouts, as the licenses have already been awarded against bids.

- Building new river ports in the Indo-Gangetic basin, given the perennial nature of the rivers.

These projects have been under much discussion. Getting these projects rolling off the ground immediately can prove to be test cases in themselves on several points. Involving the private sector, both Indian and international, will certainly help. Successful implementation of these projects can also help to build a case of India truly meaning business, and can help showcase the improved business sentiment globally. These projects will also involve significant skilled and semi-skilled labour participation, which can help to bolster the job market in a big way. Further, these cities can bolster the national economy as they will have multi-sectoral impacts – industries can set up along these corridors to take advantage of the infrastructure, and also push city economic growth. Furthermore, these projects will necessarily can help to utilize the liquidity that is now available in the market in a positive manner by tapping into the bond markets and utilization of innovative financial instruments to raise funds.

The problem exists, and in my opinion, there are immediate

answers as well. This is a trial through which the government must come out of successfully,

but will require out of the box thinking and some guts. The political mandate

for it exists; it is now for the Prime Minister and Finance Minister’s offices to give the necessary

push. It is now or never. The buck stops at the duo's offices.

Comments